Do Digital Nomads Pay Tax in Spain?

When weighing your digital nomad destination options, especially when applying for a digital nomad visa, it’s important to fully understand the implications of staying in a place. When it comes to one of the most popular digital nomad visas, we often get the question, “Do digital nomads pay tax in Spain?”

Yes, digital nomads pay tax in Spain when they meet the criteria of a tax resident.

We understand that living the digital nomad lifestyle is complicated and bureaucratic. The more information you have, the better you can make a decision about your next nomadic move.

So, Nomads Embassy has partnered with an experienced local Spanish tax advisor to share the necessary tax information you need to know before relocating to Spain.

Whether you’re applying for the Spain digital nomad visa, the non-lucrative visa, or are entering Spain another way, knowing the tax implications will help you greatly.

We always recommend speaking with a professional tax advisor to review your specific situation for the most accurate and up-to-date information.

Do Digital Nomads Pay Tax in Spain?

If a remote worker meets the criteria of a tax resident, then yes, digital nomads pay tax in Spain.

However, if a digital nomad is traveling in Spain on a tourist visa and does not hold residency or own property in Spain, and can prove their tax residency abroad then they will not owe taxes.

You see where this can get a bit tricky?

The first thing to understand when determining if digital nomads pay tax in Spain is how one becomes a tax resident.

How Do You Become a Tax Resident in Spain?

There are multiple ways someone can become a tax resident in Spain.

The 183-Day Rule

When an individual spends 183 days in a year in Spain, they will automatically become a tax resident.

This will be true for those with the Spanish digital nomad visa, as they must be present in the country for at least six months for their residency to remain valid.

Main Residence in Spain

If your main residence is located in Spain, then you will also likely become a tax resident, even if you do not spend a total of 183 days in the country. If it is your home base while you travel for work or vacation, Spain can still claim you for owing taxes.

However, if you can establish tax residency elsewhere and provide a certificate of this, the Spanish authorities will accept it and may not claim you as a tax resident.

What is a Spanish Non-Tax Resident?

It is also possible to be a Spanish non-tax resident and still owe taxes in Spain. This category applies regardless of the time spent in Spain during the year.

Spanish non-tax residents will be taxed on Spanish income and assets, including:

How Much Do Digital Nomads Pay Tax in Spain?

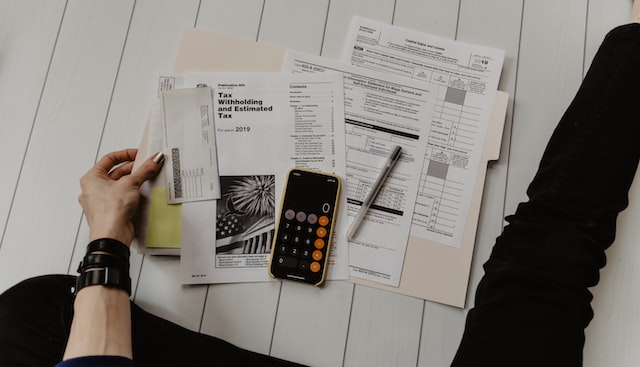

The tax rate for digital nomads in Spain is determined by your income, wealth, and if you are able to take part in any tax benefits.

Personal Income Tax

As a tax resident in Spain, you will owe tax on your worldwide income.

This means if you are in Spain on the digital nomad visa working for a company in the United States, you will pay Spanish income tax on your salary.

The personal income tax rate for income over €300,000 per year can go up to 52%.

What type of income falls under personal income?

All of these streams will be taxed as personal income in Spain.

Savings Income Tax

When you have a savings or investment account, you will also owe taxes on the money you earn in Spanish taxes.

The savings income tax rate is between 19% to 28%.

This tax will be applied to the following income:

Wealth Tax

Spain also has a wealth tax on worldwide net wealth for digital nomads who are Spanish tax residents.

However, the threshold for this tax varies depending on where you reside in Spain.

For example, residents in Catalonia must pay wealth tax on assets worth more than €500,000. However, residents in Valencia and Madrid only pay if assets are more than €3 million.

This worldwide wealth tax does not include:

Goods and Assets Abroad

Spain may also tax any goods and assets you own abroad. These assets include:

Social Security Tax

One of the main concerns when remote workers apply for the Spain digital nomad visa is the social security tax.

There are two options to pay Spain social security:

- Your employer pays it OR provides a certificate of coverage in their country

- You pay the social security tax yourself

For this reason, many applicants decide to declare themselves as freelancers so that they can pay the Social Security tax on their own.

If you decide to register as a freelancer in Spain and pay social security on your own, it’s important that you keep VAT bookkeeping records and invoices.

The first year, you will pay just €85 per month towards social security.

The second year, you will pay a percentage of your profit to social security.

You must also pay quarterly taxes, including a 20% tax on the quarterly profit.

Beckham Law Regime

What we have reviewed thus far about digital nomads paying tax in Spain is the general tax rates. However, some digital nomads may qualify for the Beckham Law Regime, which offers lower tax rates and benefits.

The law was implemented when soccer player David Beckham came to play for Spain’s team to reduce the taxes he would pay on his new salary. Now, it is available to remote workers and foreigners who decide to live in Spain.

Beckham Law Tax Benefits

The tax rates and benefits of the Beckham Law include:

- 24% flat tax on the first €600k earned in employment or freelance income

- 48% tax on anything over

- 24% tax on Spanish income

- Wealth tax only applies to Spanish assets

These benefits may also transfer to the spouse of the main applicant.

It is most convenient for employers or freelancers who earn more than €55,000 per year, have income and investments abroad, and who do not want to disclose their assets.

Who is Eligible for the Beckham Law?

To be eligible to take advantage of the Beckham Law, you must meet the following criteria:

It’s important to note that in order to apply for the Beckham Law, you must arrive in Spain with your visa or intention to apply for a resident permit. You cannot simply arrive on holiday and apply for the regime if you decide to apply for the digital nomad visa.

You must arrive in Spain as a cause of the reasons and visas listed above.

For this reason, it is extremely important to speak with a tax consultant or advisor when considering moving to Spain with the digital nomad visa. There are specific steps and processes to follow, especially if you want to take advantage of the Beckham Law.

Does Spain Have Double Taxation Treaties?

Yes, Spain has double taxation treaties with multiple countries, including the United States, Canada, Australia, and the United Kingdom.

This means that you will not pay taxes in both countries.

For US citizens, you will receive a tax credit, due to the citizenship-based tax system. Even when living abroad, US citizens must file federal tax returns annually. This tax credit from Spain will count towards any taxes owed in the US.

Is Living in Spain as a Digital Nomad Worth It?

Deciding whether it is worth living in Spain as a digital nomad is a personal decision. However, Nomads Embassy is here to give you all of the important information we think is necessary to make an informed decision about your relocation.

Spain is known for its ideal weather, vast landscapes, and affordable cost of living. Whether you’re looking to be center in a bustling city like Barcelona or living a slow life on Mallorca, there is a lifestyle for everyone in this beautiful country.

For digital nomads who want to live abroad and eventually obtain permanent residency in another country, then Spain’s digital nomad visa could be the best option for you!

How to Calculate Your Tax Rate in Spain as a Digital Nomad

The best way to accurately calculate your tax rate and how much you can expect to owe is by working one-on-one with a Spanish tax advisor. Equipped with the essential knowledge about Spain’s tax system and details, they can review your income, assets, and more, to help you determine what tax bracket you will fall under.

They can also help you with tax planning, such as applying for the Beckham Law, if you qualify.

Calculating how much tax digital nomads will pay in Spain is best left to a professional for the most accurate estimate.

If you wish to speak with Nomads Embassy’s hand-selected local tax advisor, complete the form in this article. Plus, you’ll get access to our free one-hour webinar about digital nomad taxes in Spain.

Request our free digital nomad visa eligibility check to get started!

You may also enjoy

A new digital nomad visa has popped up for remote workers… but it’s not like traditional remote worker visas we’ve talked about before. Launched in February 2026, the Bhutan digital…

by Brittany

Do you dream of living and working remotely from Sri Lanka for a year? See if you can with our free Sri Lanka digital nomad visa eligibility check! Simply answer…

by Brittany

Are you planning to apply for the Portugal digital nomad visa? Then you’ll want to read about the new eligibility changes and Portugal digital nomad visa updates for 2026. Each…

by Brittany