Can Remote Employees Apply for the Spain Digital Nomad Visa?

Determining whether you are eligible for Spain’s digital nomad visa can be quite confusing with all of the criteria and requirements. You may begin to wonder, can remote employees apply for the Spain digital nomad visa?

Yes, remote employees can apply for the Spain digital nomad visa.

When remote employees apply for the Spain digital nomad visa, they can live in the country for up to five years before obtaining permanent residency.

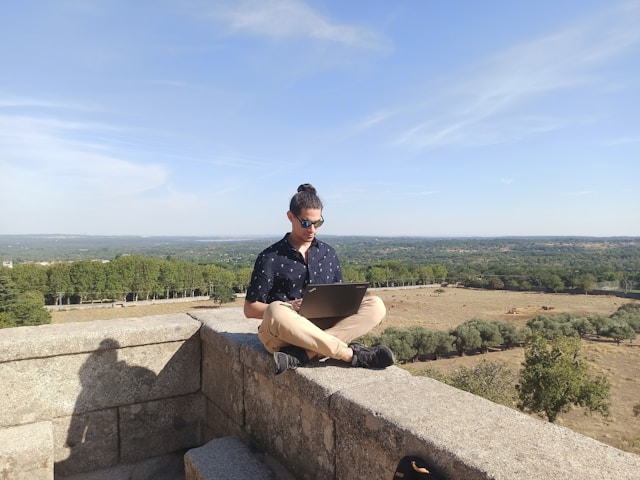

Remote employees are invited to work remotely in Spain and apply for residency with the digital nomad visa, offering an affordable cost of living, potential tax benefits, and a high quality of life.

By the end of this article, you will know how remote employees apply for the Spain digital nomad visa, what documents they need, and the implications of living in Spain as a remote employee.

What is the Spain Digital Nomad Visa?

The Spain digital nomad visa was launched in 2023 and is officially known as the International Teleworking Visa.

With this visa, digital nomads and their family members can relocate to Spain for 12 months. During this year, they may apply for a three-year residence permit, which is renewable for an additional two years.

After five years of living in Spain, they may apply for permanent residency. After 10 years, they can apply for citizenship by naturalization.

The Spain digital nomad visa is one of the most popular digital nomad visas in Europe and accepts in-country resident permit applications as long as the applicant has entered Spain legally.

By passing the initial visa application process at a Spanish consulate or embassy can save months of time for many digital nomads who are already on the move or have plans to come to Spain.

Can Remote Employees Apply for the Spain Digital Nomad Visa?

Yes, remote employees can apply for Spain’s digital nomad visa and experience all the benefits this beautiful country has to offer.

Remote employees must prove their remote work status through employment contracts expressly stating they can work remotely 100% of the time when applying for the Spain digital nomad visa.

Eligibility Requirements for Remote Employees Applying for the Spain Digital Nomad Visa

The eligibility requirements vary slightly for remote employees that apply for the Spain digital nomad visa.

Remote employees must meet the following criteria:

If you meet these requirements, you can apply for the Spain digital nomad visa as a remote employee.

Implications of Remote Employees Applying for the Spain Digital Nomad Visa

When a remote employee applies for the Spain digital nomad visa, there are some important implications to be aware of.

Social Security Coverage or Certificate

Remote employees must present proof that their company will cover Spanish social security payments or contribute to their own national social security.

There are two options as to what the employer can do:

- Produce a Certificate of Coverage showing Spain that they pay into social security for their employees (US employees can request a Certificate of Coverage here!)

- Pay Spanish Social Security each month

These are extremely important documents for remote employees who want to live in Spain with the digital nomad visa.

Company Involvement in Relocation

As you can see, your employer must be involved in your relocation to Spain. Not only will they have to come to an agreement about paying social security, but they will also have to provide written authorization for you to relocate abroad and still maintain your role in the company.

In no situation will a remote employee be able to relocate to Spain with the digital nomad visa without notifying or involving their employer.

Spanish Tax Residence

When you live in Spain with the digital nomad visa, you will become a Spanish tax resident and owe local taxes on your worldwide income and wealth.

While there are tax benefit programs, such as the Beckham Law, it is important to understand the implications of owing taxes in Spain as a digital nomad.

There is no way around not becoming a tax resident in Spain with the digital nomad, mostly because you are required to spend at least 183 days in the country out of the year for the residence to remain valid.

Employee vs. Freelancer: Which One Makes It Easier to Apply?

Some wonder whether it’s easier for remote employees or freelancers to apply for Spain’s digital nomad visa.

Overall, it is easier for freelancers to apply for the Spain digital nomad visa.

This is mostly due to the lack of company involvement for freelancers since they do not have an employer. They do not have to produce a Certificate of Coverage or convince their employer to cover their Spanish social security contributions. Instead, they are solely responsible for making these contributions.

However, they must also register as self-employed in Spain and receive a VAT number.

Many Spain digital nomad visa applicants who are employees often choose to transform their roles into independent contractor roles to simplify the Spain digital nomad visa application process.

Verify Your Spain Digital Nomad Visa Eligibility

Are you ready to start a new chapter in your digital nomad journey as a remote employee in Spain?

Avoid the struggles and see if you meet the requirements to apply with our free Spain digital nomad visa eligibility check today!

You may also enjoy

A new digital nomad visa has popped up for remote workers… but it’s not like traditional remote worker visas we’ve talked about before. Launched in February 2026, the Bhutan digital…

by Brittany

Do you dream of living and working remotely from Sri Lanka for a year? See if you can with our free Sri Lanka digital nomad visa eligibility check! Simply answer…

by Brittany

Are you planning to apply for the Portugal digital nomad visa? Then you’ll want to read about the new eligibility changes and Portugal digital nomad visa updates for 2026. Each…

by Brittany